This week’s newsletter shines a spotlight on $XRP as we dive deep into EVERYTHING you need to know about it and why we’re fundamentally and technically bullish on this asset.

In the Charts of the Week section, we shift focus to $BTC, exploring key indicators and charts that could help us gauge when Bitcoin might potentially top out this cycle. Stay tuned for detailed insights!

ENJOY THE NEWSLETTER!

The content below represents the personal views and opinions of the authors. It should not be considered as investment or financial advice.

📚 News Of The Week 🎓

Written by @CryptoinsightUK - X/Twitter

Dear readers,

This week, I want to dive deep into a topic that's been central to my analysis and investment strategy: XRP. As we navigate this bull run, I believe XRP is positioned for significant growth, not just from a technical standpoint, but also fundamentally and emotionally. In this issue, I'll share my comprehensive thesis on why I believe XRP is set to make waves in the crypto world. Let's get started!

Why $XRP

Before we dive into the specifics, a question I've been asked countless times over the past three to five years is: why am I so heavily invested in XRP, and why not diversify more? My honest answer is that I've researched XRP more than any other crypto. When I compare it to other cryptocurrencies, it doesn't make sense for me to invest in something I know less about. That's why I've been heavily weighted in XRP.

I also believe the risk-to-reward ratio is massively skewed to the upside. When you have such an opportunity, it only makes sense to allocate heavily. Many people structure their crypto portfolios with a large portion in top assets like Bitcoin and Ethereum. But even in the best-case scenario, Bitcoin might offer a three to five times return, maybe up to ten times in a golden cycle. Ethereum is similar.

However, XRP has a very realistic chance of breaking out of its current range, with upside potential anywhere from ten to forty times. This is with similar downside risk as Bitcoin and Ethereum, especially since XRP has held relatively stable despite negative attention and being singled out by the SEC. I've always felt that the downside risk was already priced into XRP, while the upside wasn't priced in enough due to the world's narrative towards the asset. This discrepancy between perception and reality is exactly why I've been so confident in my XRP investment strategy.

$XRP Fundamentals

Now, let's delve into the fundamentals of XRP and its developments over the years. One argument I've consistently made is that no cryptocurrency currently has a tangible impact on a global scale. Bitcoin, for instance, is often touted as digital gold, but it hasn't yet proven itself over time in the way that gold has. Ethereum, while lauded for its potential as the 'internet of value' or the application layer of the internet, doesn't yet offer solutions that contribute significantly to everyday life. The high price of ETH is largely speculative, banking on its future potential rather than current utility, which is why we're seeing the rise of ETH Layer 2 solutions. Whether these are the answer remains to be seen, but currently, Ethereum is neither efficient nor a definitive upgrade.

On the other hand, XRP has always shown real-world impact, albeit on a smaller scale. Its most evident use case is in cross-border payments, where it's already making a positive difference in the traditional financial sector. While its market share isn't as large as we'd like it to be yet, XRP is contributing to the real world, offering a provable use case that's being utilized right now.

While I won't delve into the numerous partnerships Ripple has established, which are a testament to the XRP Ledger's growing adoption, I'll highlight a few key players. Ripple's collaborations include the Hong Kong Monetary Authority, which underscores XRP's potential in the financial sector. Partnerships with central banks like those of Montenegro and Bhutan further demonstrate the global reach and real-world use cases of XRP in enhancing cross-border payment systems. This is just to name a few off the top of my head, there are LITERALLY 100s in the cross boarder payments sphere.

In addition to cross-border payments, there's been a significant push towards the development of real-world assets on the XRP Ledger. For instance, Ripple was selected by the Hong Kong Monetary Authority to demonstrate how mortgages and house deed transactions could be settled on the XRP Ledger. We've also seen land tokenization initiatives, like the one by Peersyst in Colombia. Now, there's growing speculation that the XRP Ledger could become the premier platform for real-world assets. This is supported by insights from Axelar, a cross-chain bridge, which discusses how Ripple's rLUSD could capture market share and position itself as a key player in institutional DeFi. This aligns with the broader trend of integrating real-world assets into the crypto ecosystem, expanding XRP's role in the financial landscape.

RLUSD and The USA

This brings me to Ripple's stablecoin, RLUSD. While it hasn't officially launched yet, its confirmed announcement suggests an imminent debut. This development is poised to play a critical role in expanding XRP's utility, particularly in the realms of institutional DeFi and real-world asset tokenization.

Although RLUSD has yet to launch, I believe it could be pivotal for the narrative and increased adoption of the XRP Ledger. This is especially relevant given recent catalysts in the USA, where Ripple has been embroiled in a lawsuit with the SEC for nearly four years. With the recent announcement of resignation from Gary Gensler, there are signs that this prolonged legal battle may finally be approaching a resolution, potentially clearing the path for greater clarity and growth for XRP.

Moreover, following Donald Trump's election, we've seen a positive reaction in prices, likely fueled by speculation that Gensler's departure would be a key catalyst. Another significant factor is Trump's announcement of plans to establish a crypto advisory board, with Ripple rumored to be involved. I believe there's a strong likelihood of Ripple's participation, as it would align well with the interests of both the United States and the Trump administration. Adding to this, we've recently observed open discussions on Twitter between Charles Hoskinson, co-founder of Cardano, and Brad Garlinghouse, CEO of Ripple. Hoskinson has strongly hinted at playing a role in shaping the future of cryptocurrency regulation within the next U.S. administration.

I see this as a strategic move by Donald Trump and the U.S., akin to a game of 5D chess. Elon Musk has long pointed out a potential demographic issue in the U.S., with younger people having fewer children partly due to financial constraints. Many of Trump's voters are young cryptocurrency holders, and by enabling them to increase their wealth through favorable crypto policies, we could see a boost in the younger demographic's financial stability, potentially encouraging higher birth rates.

Additionally, promoting cryptocurrency could bring capital back to the U.S., aligning with Trump's goal of onshoring industries. This move would not only create jobs but also attract intellectual capital, drawing talent from around the world to a crypto-friendly environment. This strategy seems like a way to achieve multiple objectives: boosting the economy, supporting his voter base, and making America a hub for crypto innovation. Companies like Ripple, Algorand, and Cardano are poised to be at the forefront of this potential crypto renaissance in the U.S.

Retail and XRP

Shifting focus to retail and the broader market sentiment towards XRP.

Many retail investors have been holding XRP for years, some since the $3 highs of the 2017 cycle. For those who haven't sold, this could mean they've been underwater for up to seven years. Psychologically, many of these investors might initially think about selling when XRP hits $3, just to break even. However, after holding for so long and seeing it finally turn green, they might have a psychological shift. Instead of selling, they may decide to hold on or even buy more, encouraged by the turnaround. This change in sentiment could lead them to share their positive experiences with friends, potentially sparking a new wave of interest. It’s one of those things where despair turns into belief.

Turning to perceptions of XRP within the crypto community, there's a notable amount of blind skepticism, often based on outdated narratives, many of which are either exaggerated or entirely unfounded. Despite this, many critics will likely buy in once XRP breaks key levels, driven by a fear of missing out on potential gains. This FOMO could trigger a wave of buying as XRP crosses $1, $2, and certainly its all-time highs, transforming skepticism into aggressive market momentum.This dynamic feeds into my risk-to-reward thesis: when emotions run high around an asset, whether positive or negative, there's often value to be found on the other side of that sentiment.

There's also a significant segment of the XRP community that's almost cult-like in their belief that XRP will reach $1,000 or more. This group is unlikely to sell their holdings at current prices, effectively taking a portion of XRP's circulating supply off the market. This reduction in available supply can have a significant impact on market dynamics, potentially driving up the price as demand outstrips the available XRP for trading.

Lastly, let's touch on the recent introduction of meme coins on the XRP Ledger, a topic I've discussed before. While not everyone's cup of tea, it indicates a space for speculative activity and highlights the attention meme coins are garnering, as seen with Solana. Once meme coins are integrated into platforms like Dexscreener, which seems imminent, and XRP itself is on the rise, we could see capital rotation within the ecosystem. Just as ETH holders rotated into NFTs in the last cycle, we might witness a surge in XRP meme coins. This trend offers a playground for XRP holders to leverage their gains, potentially mirroring across other ecosystems as XRP's performance draws attention. It's another piece of the puzzle that adds to the retail dynamics around XRP. I think memes are overall bullish for the ecosystem, the more people trading memes, the less capital flight from the XRPL

REMEMBER, if you want to trade memes, please do so via my link here - https://firstledger.net/?ref=6NRu4StwrImq

XRP TA and Thoughts

We'll explore some potential price targets and delve into what I see unfolding technically for XRP. Whether it's identifying key support and resistance levels, chart patterns, or momentum indicators, we'll paint a comprehensive picture of XRP's current technical landscape and where it might be headed.

First off, I want to discuss this chart;

The longer the base, the higher in space. Most recently, XRP has been trading within a range between approximately $0.91 and a low of around $0.28 for over a thousand days (1,078 days) before we saw a range break. Prior to that, XRP traded in a wider range between roughly $0.10 and $3.5, including where we are today, for over 2,500 days (2,506 days, to be precise).

These extended periods of accumulation and consolidation resemble a coiled spring. Once the energy is released, the moves can be extremely aggressive and explosive. We've seen XRP exhibit similar behavior in the past, notably in 2017, where a long consolidation phase was followed by a historic rise. In this scenario, we see a confluence of standard technical analysis, with the basing structures indicating potential for a strong move, coupled with XRP's historical price action. We've seen this pattern play out before, where, following a prolonged consolidation, XRP experienced highly aggressive breakouts.

If we look back at 2017, following the range break, XRP saw an initial surge of 494% before its first significant pause. After a brief consolidation of about three to four weeks, it then skyrocketed by 3,800% from the range break to its peak before a longer pause. This translated to a remarkable 38x increase from the range break price over a period of about two to three months.

After that initial surge, XRP entered a longer consolidation phase before completing its move, ultimately peaking at around $3. This culminated in a staggering 30,000% gain, with some estimates even reaching 50,000%, equating to a 300x to 500x increase from the bottom.

Before we dive deeper into the charts, it's crucial to consider various factors, especially where the total crypto market cap will peak. This greatly influences XRP's potential price. For instance, if XRP dominance tops out at 30%, as it did in the 2017 cycle (31% to be precise), 30% of a $3.25 trillion market (where we are now) is significantly less than 30% of a $10 to $12 trillion market, which is where I think we could end up at the cycle's peak. So, when considering price targets, remember: the more capital flowing into the market, the higher XRP's price expansion potential.

What we can see is that there are multiple key levels for XRP dominance: 4%, 6%, 14%, 20%, and 31%. Each of these levels could potentially act as resistance. Now, let’s assume we don’t see a full extension to 31%. What would XRP’s price be if dominance reached the 14% today level in the current crypto market?

If XRP hit that today, it would be worth approximately $8.75.

So that’s something to work with.

I personally believe the total market cap of crypto is going to expand to somewhere between $10 and $12 trillion over the next 3-9 months. So that could be up to a 3x of the price quoted above (around $25 - 30 in a perfect world) based on market cap and dominance (not to mention if dominance went higher than 14%.....).

Next, I want to focus on XRP against Bitcoin, which I like to view inverted. This upside-down perspective provides, in my opinion, the clearest way to interpret the chart. On the weekly timeframe, you can see that we've created four consecutive higher lows. However, very recently, this week, we've lost a key support level (broken a key resistance).

The last time this happened, back in 2017, XRP quickly puked against Bitcoin, hitting a bottom (top) that was around a 16X from where we are now. Currently, we've broken out slightly, so let’s call it a 15X from here. That projection would put XRP’s price in the range of approximately $17 to $18. Once again, this aligns well with the broader price region we’re looking at, which spans from $8 to $30.

Next, looking at XRP versus Ethereum, the chart appears to have completed a Wyckoff accumulation pattern. A breakout from this range or continued push could result in gains against ETH of 100%, 200%, or even up to 800%. An 800% gain would put XRP in the price region of around $10, once again aligning with the range I’ve been discussing. This would reflect XRP matching the dominance against Ethereum that it had back in early 2018.

Again, this assumes ETH would not increase in price at all until XRP catches up (likely it does, making XRP vs USD price even higher…)

Finally, if we look at XRP versus the dollar and apply a simple Fibonacci retracement, we see a potential top in the range of $11.90 to $13.90. Once again, this aligns with the broader price range we've been discussing.

That said, it's important to remember that during the 2017 cycle, XRP didn’t just hit the Fibonacci retracement levels—it smashed right through them. It even went significantly beyond the 4.236 extension, climbing an incredible 1,219% higher than what a typical Fib extension would predict.

So, take from that what you will. Personally, I’m targeting a high of $12 to $15, maybe even $17 for XRP this cycle. However, as I’ve shown, it’s very possible we could see an extension into the $20s, and in a best-case scenario, perhaps even the $30s, if XRP dominance and the total market cap align perfectly. Ultimately, it’s up to you to decide where to take profits. As you can see, there are key levels along the way, and many long-term holders will likely take profits aggressively, which could shift the market dynamics. But for me, I firmly believe that double-digit XRP is inevitable this cycle.

📈 Charts Of The Week 📉

Written by @thecryptomann1 - X/Twitter

$BTC

What an incredible week it’s been for the crypto market! Bitcoin continues to print green candles, leaving the bears in the dust. Naturally, this has many asking: when will we see a correction? It’s a logical question at this stage.

If we do see a short-term correction, I think it’ll likely occur around the $102K range. This is because $BTC is approaching the 1.618 Fibonacci retracement level, and $100K is a significant psychological price point. I expect to see some selling pressure around this level.

IF we do see a short-term correction, $89,000 makes sense. If anything a correction and subsequent bounce here would be so bullish!

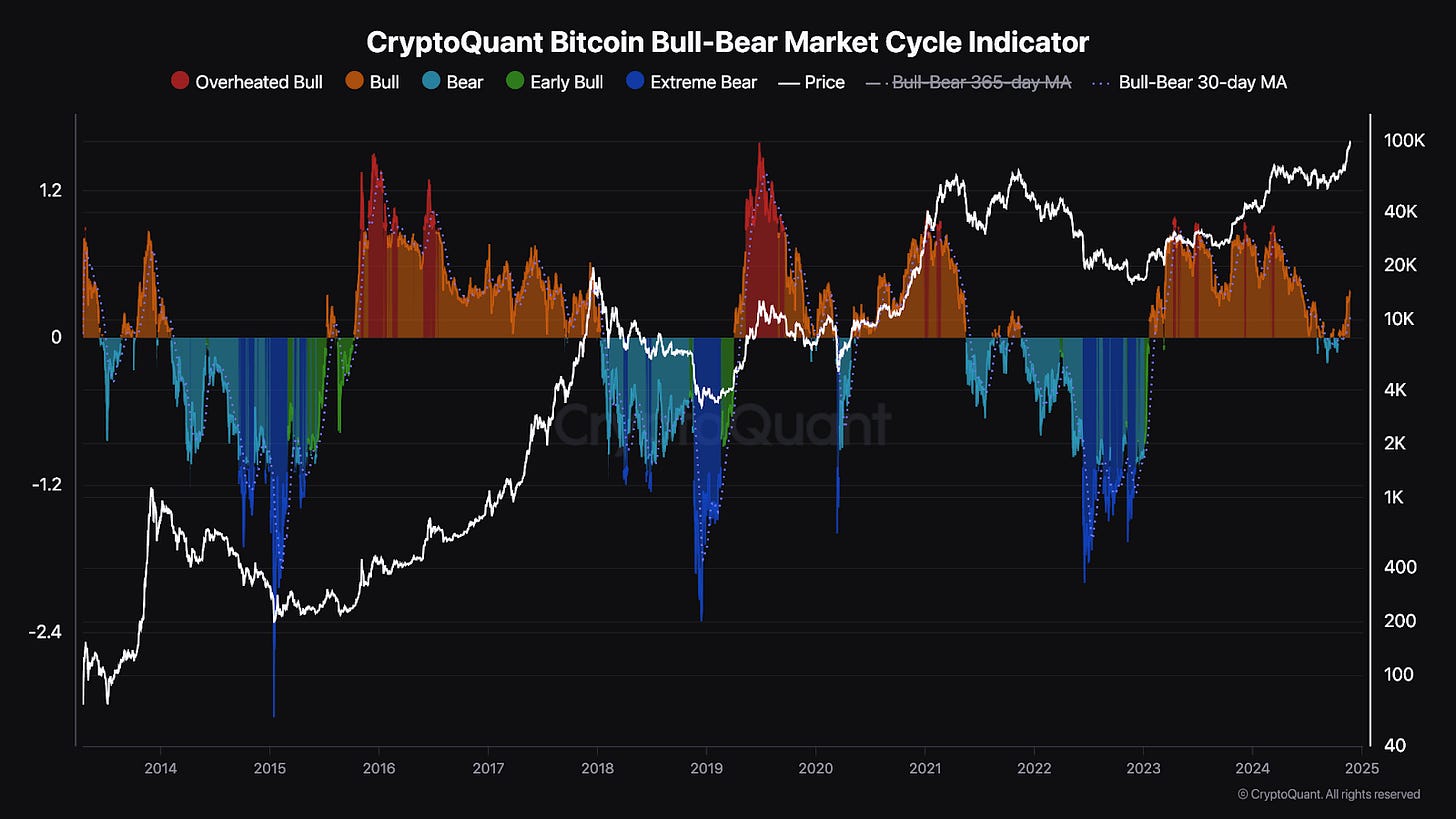

$BTC Bull-Bear Market Cycle Indicator

Now that the $BTC bull run is heating up, it’s crucial to keep a close eye on indicators and charts that might hint at when things are getting too heated and where $BTC could potentially top out.

One chart that could provide valuable insight is the Bull-Bear Market Cycle Indicator. When this starts to signal an 'overheated bull,' it’s time for the alarm bells to ring. While it doesn’t perfectly time the top, this chart serves as a useful warning when the market reaches a truly euphoric state.

Bitcoin Realized Price

Another chart that can help you gauge where Bitcoin might top out is the Realized Price Bands. Historically, this has been a reliable indicator for identifying potential $BTC tops.

That said, it’s important to use this as a guide rather than a guarantee. As Bitcoin approaches the upper band, it should serve as a warning that the bull market may be cooling off or that a correction could be on the horizon. Right now thew upper band is sitting at $140K but as $BTC appreciates, the upper band rises. So it’s important to stay updated on this chart.

$BTC Funding Rates

Finally, let’s touch on $BTC funding rates. Despite all the positive market sentiment and price action, funding rates still aren’t in the danger zone just yet. This suggests Bitcoin could climb higher before experiencing any sort of correction.

When we compare current funding rates to what they were in March, they’re still nowhere close, even though open interest remains at all-time highs. As I’ve mentioned in previous editions, plenty of traders are still piling on shorts for $BTC.

Let this serve as a reflection of market sentiment for you guys: while the price action might suggest things are overcooked, a closer look shows there are still many bearish traders in the market right now. Once funding rates start approaching March levels, it might be time to exercise caution.

I can’t add the chart as this newsletter has exceeded the maximum length so go and check out my X/Twitter: @thecryptomann1.

LINKS:

This newsletter is free because we love sharing our insights with the community. If you enjoy it and find value in our work, consider supporting Pav's and Will's Beer/Coffee Fund by donating $XRP to our newsletter donation wallet below. Cheers!

$XRP donation wallet: r3qf2nALyhFwC46QqZ5gJHpF3cjr5gRcoV

Trade XRP Memes here:

https://firstledger.net/?ref=6NRu4StwrImq

Trade on MEXC: https://www.mexc.com/register?inviteCode=mexc-1etb1

Trading Different - https://t.co/3ks3QMT5VJ?ssr=true

Appreciate the content Will and reading it I can not curtail the excitement !!!! also the fact your are

Giving this away for free is astounding !! Thank you !!